tennessee inheritance tax laws

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an. Tennessee Taxpayer Access Point TNTAP Find a Revenue Form.

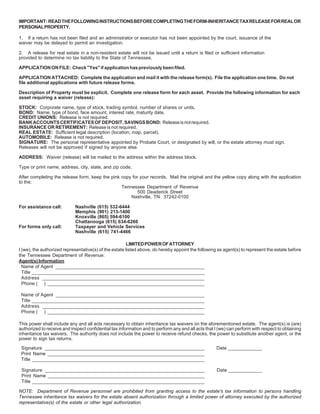

Affidavit To Waive Filing Of Tennessee Inheritance Tax Return 007 Pdf Fpdf Doc

For example the state of Tennessee does not follow strict community property inheritance laws which means you must be careful when it comes to creating an estate plan.

. Inheritance Laws in Tennessee Probate in Tennessee. 11 rows There is a single exemption against the net estate of a Tennessee decedent in the following amounts depending on the year of the decedents death. Tennessee Inheritance Tax Laws.

The trusts assets will need to be identified and valued the decedents debts and expenses will have to be paid the trust will need a tax identification number a trust tax return may need to be filed and in the end the trusts assets will need to be distributed to the beneficiaries. Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax. However it applies only to the estate physically located and transferred within the state between.

Please DO NOT file for decedents with dates of death in 2016. We hope the following information provides some basic information about Tennessees. Technically Tennessee residents dont have to pay the inheritance tax.

Schedule an Informal Conference. The inheritance tax is no longer imposed after December 31 2015. Details on Tennessees probate and estate tax laws are outlined below.

Inheritance taxes in Tennessee. The Tennessee Inheritance Tax exemption is steadily. For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000.

Get My Tax Questions Answered. The good news is that Tennessee is not one of those six states. Register a Business Online.

IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. There is a chance though that another states inheritance tax will apply if you inherit. The Tennessee state legislature has enacted legislation to gradually increase the inheritance tax exemption amount before completely.

For nonresidents of Tennessee an estate may. There are NO Tennessee Inheritance Tax. All inheritance are exempt in the State of Tennessee.

Tennessee Code Title 30. Tennessee Inheritance and Gift Tax. Probate is a court-supervised process that gives a family member such as a surviving spouse or.

For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. If the total Estate asset property cash etc. The beneficiaries and heirs will need to be notified of the death of the Grantor.

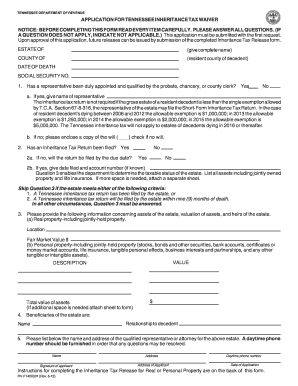

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. There are 38 states in the. For nonresidents of Tennessee an estate may.

Tennessee does not have an inheritance tax either. Tennessee has followed suit. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice.

State Inheritance Tax Return Long Form.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Transfer On Death Tax Implications Findlaw

Moved South But Still Taxed Up North

Tennessee Rv F1310501 Fill Out Sign Online Dochub

13 Estate Planning Terms To Know James D Foster Law

Is There A Tennessee State Estate Tax Mendelson Law Firm

Inheritance Laws In Tennessee Wagner Wagner Attorneys At Law

State Estate And Inheritance Taxes Itep

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Financial Assets And Liabilities Form Burdette Law Firm

What Is An Inheritance Tax And Do I Have To Pay It Ramsey

How Probate Works In Tennessee Herndon Coleman Brading Mckee

Top Rated Knoxville Tn Prenuptial Agreements Attorney Prenuptial Agreements Lawyer In Knoxville Tennessee Landry Azevedo Attorneys At Law

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)